Unlock Your Dream Car: The Ultimate Guide to Low Interest Auto Loans in 2025

Introduction

In 2025, the dream of owning a car is more attainable than ever, thanks in large part to low-interest auto loans. As consumers navigate the automotive landscape, understanding the intricacies of auto financing is crucial to maximizing their purchasing power. This ultimate guide will explore everything you need to know about securing low-interest auto loans, enabling you to unlock your dream car without compromising your financial future.

Understanding Auto Loans

Auto loans are a type of secured loan specifically designed for purchasing a vehicle. The vehicle itself serves as collateral, which means that if you default on the loan, the lender can repossess it. Auto loans typically come with fixed or variable interest rates, and the terms can range from a few years to several. Understanding the fundamentals of auto loans can help you make informed decisions when shopping for financing options.

The Importance of Interest Rates

Interest rates play a pivotal role in determining the overall cost of your auto loan. A lower interest rate translates to lower monthly payments and less money paid in interest over the life of the loan. In 2025, interest rates are influenced by various factors, including the economy, inflation rates, and the Federal Reserve’s monetary policy. Therefore, it's essential to keep an eye on these factors when looking for a loan.

Factors Affecting Interest Rates in 2025

Several factors contribute to the interest rates you may encounter when applying for an auto loan in 2025:

- Credit Score: Your credit score is one of the most significant factors influencing your interest rate. A higher credit score typically results in lower interest rates, as lenders view you as a lower risk.

- Loan Term: The length of your loan can also affect your interest rate. Generally, shorter loan terms come with lower interest rates, while longer terms can lead to higher rates.

- Down Payment: Making a larger down payment can lower your interest rate, as it reduces the lender’s risk. A substantial down payment signals to lenders that you are financially stable.

- Market Conditions: Economic conditions, including inflation and the overall demand for auto loans, can influence interest rates. Staying informed about market trends can help you time your loan application better.

Types of Auto Loans

When considering an auto loan, it's essential to understand the different types available:

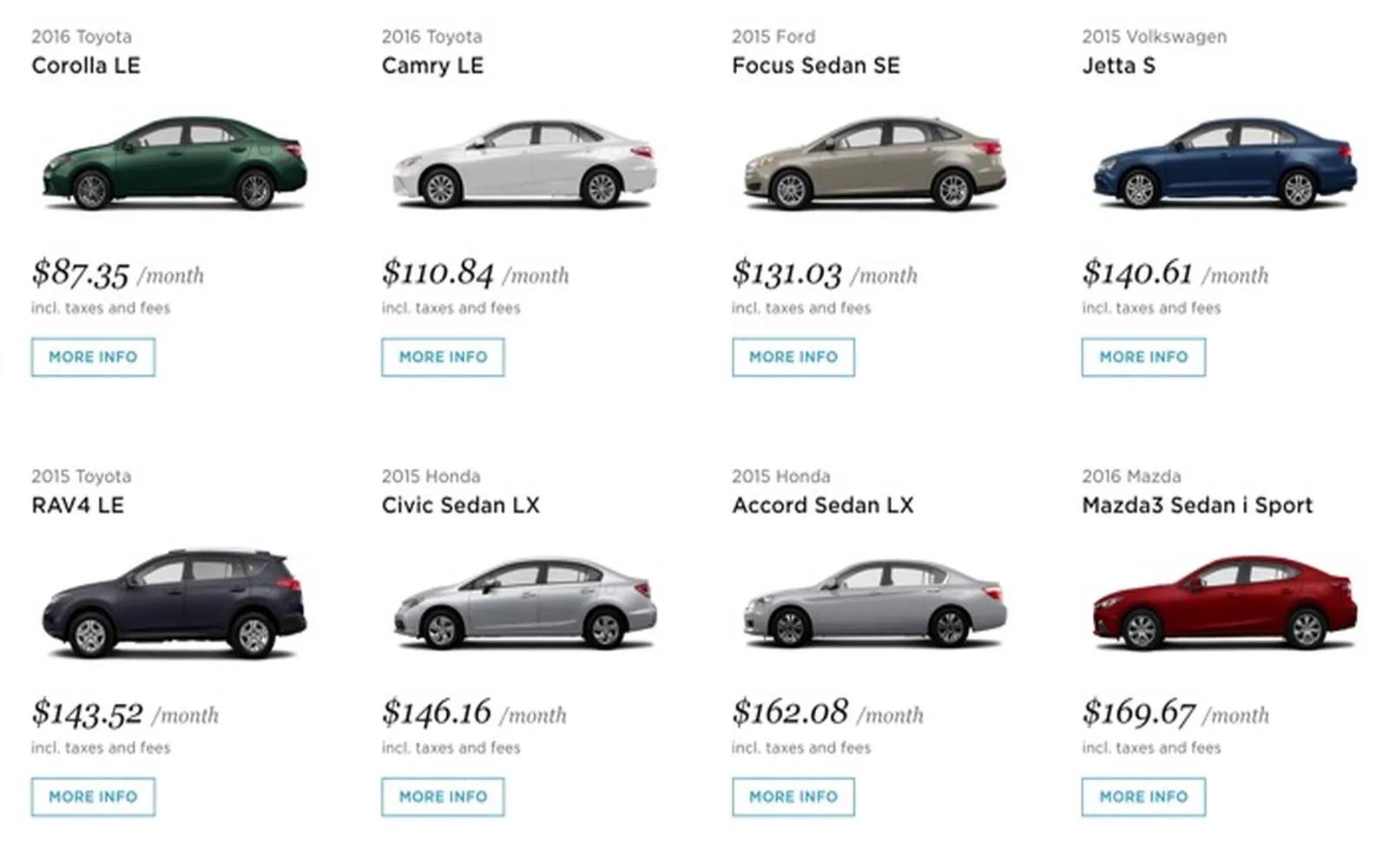

- New Car Loans: These loans are specifically designed for purchasing new vehicles and often come with the best interest rates.

- Used Car Loans: Financing for used cars typically has higher interest rates than new car loans but can still be competitive.

- Refinancing Loans: If you already have an auto loan, refinancing can help you secure a lower interest rate, potentially saving you money over time.

- Lease Buyout Loans: If you’re leasing a car and decide to purchase it at the end of the lease term, a lease buyout loan can help you finance the purchase.

How to Secure a Low-Interest Auto Loan

Securing a low-interest auto loan requires preparation and strategy. Follow these steps to improve your chances of getting the best rates:

1. Check Your Credit Score

Your credit score is the first thing lenders will look at when you apply for a loan. Obtain a copy of your credit report and check your score. If your score is lower than you'd like, consider taking steps to improve it before applying for a loan.

2. Research Lenders

Not all lenders offer the same rates and terms. Research various banks, credit unions, and online lenders to find the best options. Online comparison tools can help you quickly evaluate different offers.

3. Get Pre-Approved

Before you start shopping for a car, seek pre-approval from lenders. This process allows you to understand how much you can borrow and what interest rates you qualify for. Pre-approval also gives you an edge during negotiations with dealers.

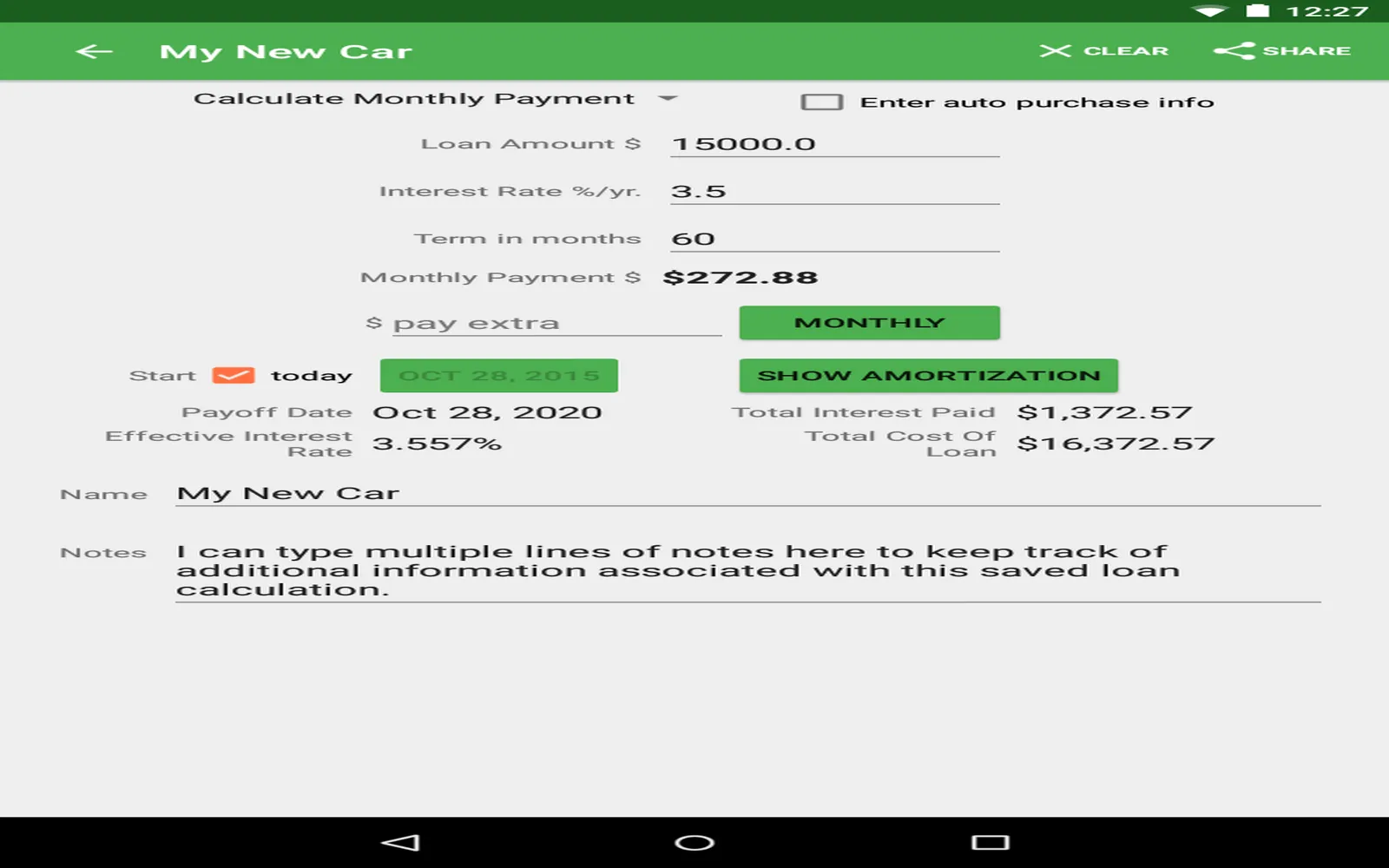

4. Consider Loan Terms

When selecting a loan, consider the terms carefully. While longer loan terms may result in lower monthly payments, they often come with higher overall interest costs. Aim for a term that balances affordability and total cost.

5. Make a Larger Down Payment

A larger down payment can significantly reduce your loan amount and improve your chances of securing a lower interest rate. Aim to put down at least 20% of the vehicle's price if possible.

6. Shop Around

Don’t settle for the first offer you receive. Shop around and compare rates from multiple lenders. Even a small difference in interest rates can save you a significant amount over the life of the loan.

7. Negotiate

Once you have an offer, don’t be afraid to negotiate. If you have received better offers from other lenders, use that information to negotiate for better terms.

Understanding Loan Terms and Conditions

Before signing on the dotted line, it’s crucial to understand the loan terms and conditions fully. Here are some key elements to look out for:

1. Annual Percentage Rate (APR)

The APR represents the total cost of borrowing, including interest and any fees. It’s essential to look at the APR rather than just the interest rate to get a clearer picture of your loan's cost.

2. Loan Term

The loan term refers to the duration you have to repay the loan. Shorter terms generally come with higher monthly payments but lower overall interest costs.

3. Prepayment Penalties

Some loans may have prepayment penalties, which are fees charged if you pay off your loan early. Check if your loan includes this condition, as it can impact your ability to refinance or pay off the loan sooner.

4. Fees and Charges

Be aware of any additional fees, such as origination fees, documentation fees, or late payment fees. Understanding these charges can help you avoid surprises later on.

Common Pitfalls to Avoid

While navigating the world of auto financing, it's easy to fall into common traps. Here are some pitfalls to avoid:

1. Ignoring Your Budget

It's easy to get caught up in the excitement of purchasing a new car. However, always stick to your budget and ensure that your monthly payments are manageable within your financial situation.

2. Failing to Read the Fine Print

Always read the loan agreement thoroughly. Understanding the terms and conditions can prevent unexpected surprises and financial strain down the line.

3. Rushing the Process

Take your time to research and compare offers. Rushing into a loan can lead to unfavorable terms and higher costs.

4. Neglecting Insurance Costs

When budgeting for a car, don't forget to factor in insurance costs. Some vehicles come with higher insurance premiums, which can impact your overall budget.

The Future of Auto Loans

As we move further into 2025, the landscape of auto loans is likely to evolve. Here are some trends to watch for:

1. Digital Financing Solutions

With the increasing reliance on technology, online lending platforms are becoming more popular. These platforms often provide quick approvals and competitive rates, making it easier for consumers to secure financing.

2. Green Financing Options

As electric and hybrid vehicles gain popularity, lenders may offer specialized financing options for these vehicles. Lower interest rates or incentives for eco-friendly purchases could become more common.

3. Enhanced Consumer Protection

As regulations evolve, consumers may see increased protections against predatory lending practices. This could lead to more transparent lending practices and better terms for borrowers.

Conclusion

Unlocking your dream car in 2025 is not just about finding the right vehicle; it’s also about securing a low-interest auto loan that fits your budget and financial goals. By understanding the factors that affect interest rates, knowing how to shop for loans, and avoiding common pitfalls, you can make informed decisions that lead to successful car ownership. With careful planning and research, your dream car is within reach!

Explore

2025 Ultimate Guide to Car Loan Calculators: Calculate Your Perfect Auto Financing Today!

Lease Sports Car Deals for 2025: Unleash Your Dream Ride Today!

Refinance Private Student Loans of 2024 – Save on Interest and Simplify Your Payments

Unlocking the Road to Ownership: Your Ultimate Guide to Auto Financing

Wedding Organizer Website – Make Your Dream Wedding a Reality

Best App Developers for Startups – Build Your Dream App with Experts

Car Lease Deals of 2025: Unlock Affordable Options for Your Next Ride

Car Financing Offers for 2025: Unlock the Best Deals and Savings Today!