Car Financing Offers for 2025: Unlock the Best Deals and Savings Today!

Understanding Car Financing: An Overview

As we move into 2025, the automotive financing landscape is evolving rapidly, offering consumers a variety of options to make car ownership more accessible. With the rise of electric vehicles, changing interest rates, and innovative financing solutions, understanding the options available can help you unlock the best deals and savings. This article will delve into the car financing offers for 2025, helping you navigate through the financial maze to find the best deal for your next vehicle.

The Current Landscape of Car Financing in 2025

The car financing market in 2025 is characterized by competitive interest rates, diverse financing options, and incentives aimed at promoting electric and hybrid vehicles. With the Federal Reserve adjusting interest rates in response to inflation and economic activities, the prevailing rates for auto loans have seen fluctuations. As a result, it's essential for potential car buyers to stay informed about current rates and how they can impact monthly payments.

Types of Car Financing Options

When considering financing for your vehicle, several options are available. Understanding these can help you choose the right path for your financial situation:

1. Traditional Auto Loans

Traditional auto loans are offered by banks, credit unions, and online lenders. These loans typically feature fixed interest rates, allowing borrowers to make predictable monthly payments over a specified term, usually ranging from 36 to 72 months. In 2025, many lenders are offering competitive rates, especially for those with good credit scores.

2. Lease Financing

Leasing has become an attractive option for many consumers who prefer lower monthly payments and the flexibility of driving a new car every few years. In 2025, lease offers are more favorable than ever, especially for electric vehicles. Many manufacturers are providing incentives to encourage leasing, making it an appealing choice for budget-conscious buyers.

3. Manufacturer Financing Offers

Automakers often provide special financing offers to attract buyers to specific models. These offers can include low or zero-percent financing for qualified buyers. In 2025, many manufacturers are promoting electric and hybrid vehicles through attractive financing packages, making it easier for consumers to transition to greener options.

4. Peer-to-Peer Lending

Peer-to-peer (P2P) lending platforms have gained traction as an alternative to traditional financing. In 2025, these platforms connect borrowers directly with individual investors, often resulting in lower interest rates. This option can be particularly beneficial for those with less-than-perfect credit.

Factors Influencing Your Financing Options

Several key factors can influence the financing options available to you in 2025:

1. Credit Score

Your credit score is one of the most significant factors lenders consider when determining your loan terms. In 2025, a higher credit score can qualify you for lower interest rates and better financing options. It's advisable to check your credit report and address any discrepancies before applying for a loan.

2. Down Payment

Making a larger down payment can significantly impact your financing options. In 2025, many lenders may offer better rates to those who can put down 20% or more of the vehicle's purchase price. A substantial down payment reduces the loan amount and can lead to lower monthly payments.

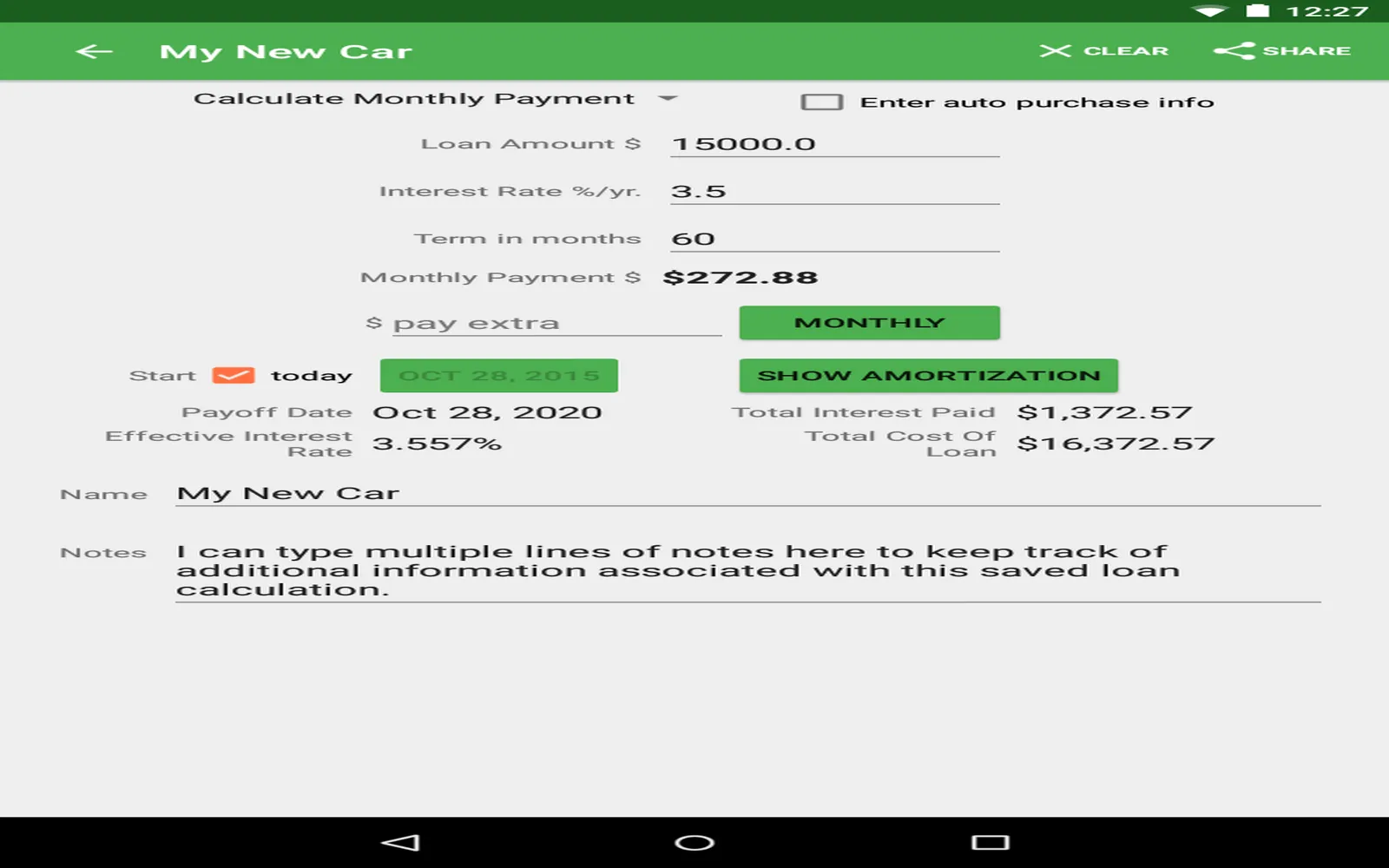

3. Loan Duration

The length of your loan can also affect your interest rate and monthly payments. While longer loan terms may result in lower monthly payments, they often come with higher interest costs over the life of the loan. In 2025, consider the trade-offs when selecting your loan duration.

4. Vehicle Type

The type of vehicle you choose can influence your financing options. Electric and hybrid vehicles are often eligible for special financing offers and incentives, reflecting a growing trend towards environmentally friendly transportation. In 2025, many lenders are keen to finance these vehicles, making them a viable option for eco-conscious consumers.

Finding the Best Car Financing Offers in 2025

Now that we understand the various financing options and factors influencing them, let’s explore how to find the best car financing offers in 2025:

1. Research and Compare Rates

Before committing to any financing option, it's crucial to research and compare rates from multiple lenders. Online comparison tools can help you quickly assess the best rates available based on your credit profile and desired loan amount.

2. Consider Pre-Approval

Getting pre-approved for an auto loan can give you a clearer picture of your budget and strengthen your negotiating position at the dealership. Many lenders offer pre-approval online, allowing you to see what rates you qualify for before shopping for your vehicle.

3. Check for Manufacturer Incentives

4. Negotiate Terms

Don’t hesitate to negotiate the terms of your financing. Dealerships often have the flexibility to adjust interest rates and terms based on your creditworthiness and the vehicle you choose. Being informed and confident can lead to better deals.

Tips for Maximizing Savings on Car Financing

To maximize your savings on car financing in 2025, consider the following strategies:

1. Pay Attention to Total Cost

While it's easy to focus on monthly payments, it's essential to consider the total cost of the loan. Look beyond the interest rate and evaluate the overall amount you will pay throughout the loan term. This can help you make more informed decisions.

2. Don't Rush Your Decision

Take your time when choosing a financing option. Rushing into a decision can lead to missed opportunities for better deals. Spend time researching and weighing the pros and cons of each financing option available to you.

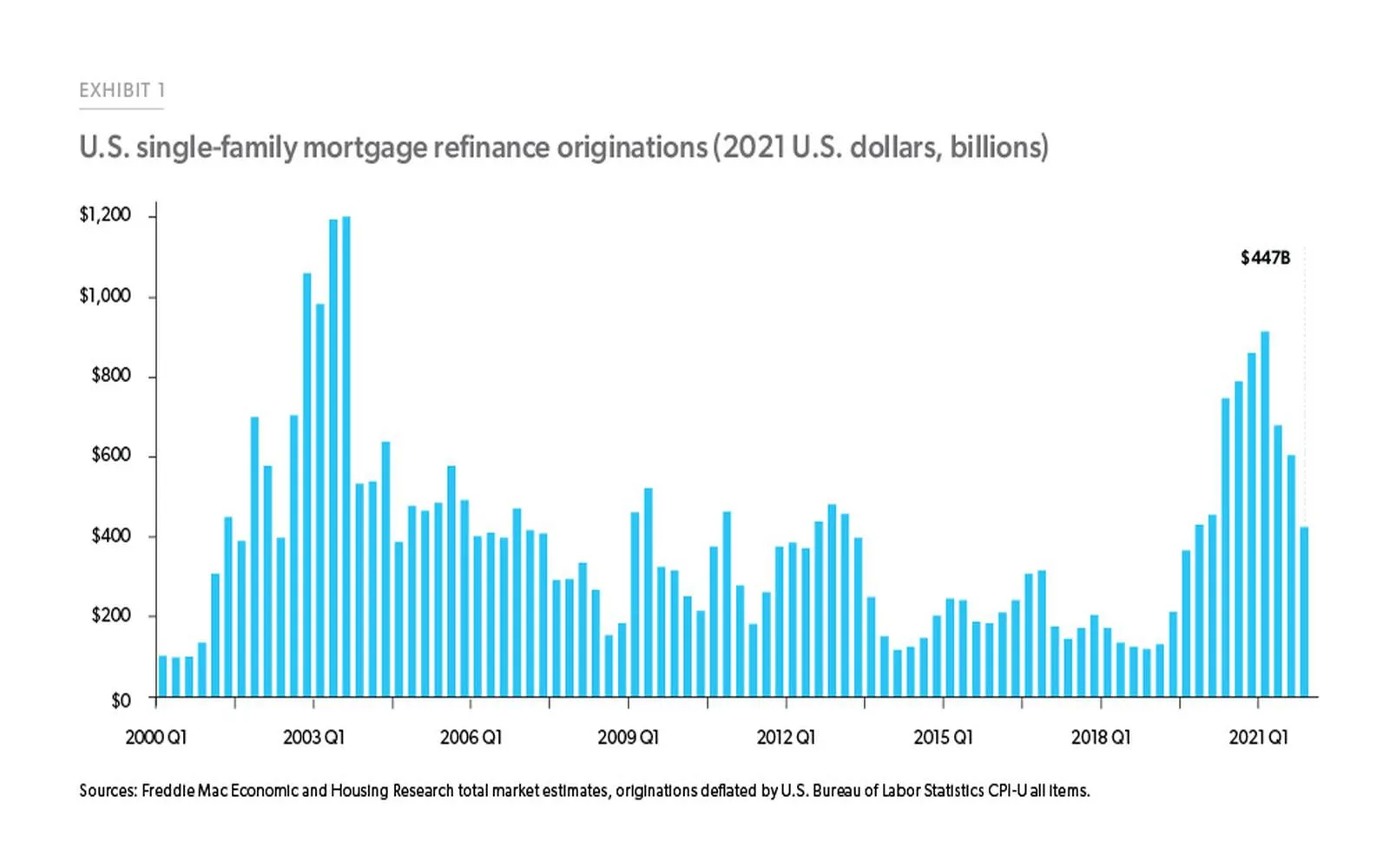

3. Explore Refinancing Options

If you secure a loan and later find better rates, consider refinancing. In 2025, many lenders are allowing easy refinancing options, which can lead to lower monthly payments or reduced interest costs over the life of the loan.

4. Stay Informed About Market Changes

Stay updated on changes in the car financing market. Economic developments, interest rate shifts, and new incentives can all influence your financing options. Being informed will help you spot opportunities for better financing deals.

Conclusion: Your Path to Affordable Car Financing in 2025

As we head into 2025, the opportunities for car financing are more abundant than ever. By understanding the various financing options, the factors influencing your choices, and the strategies for maximizing savings, you can unlock the best deals for your next vehicle. Whether you opt for a traditional auto loan, lease financing, or take advantage of manufacturer incentives, being proactive and informed will empower you to make the best financial decisions for your situation. Start your journey towards affordable car financing today and drive away with the vehicle you've always wanted.

Explore

Senior Cell Phone Deals: Best Plans & Offers for Savings

2025 New Car Lease Specials: Unbeatable Deals and Offers You Can't Miss!

2025 Ultimate Guide to Car Loan Calculators: Calculate Your Perfect Auto Financing Today!

Best Car Lease Deals Today — Save Big on Your Next Ride

Lease Sports Car Deals for 2025: Unleash Your Dream Ride Today!

Unbeatable Travel Deals: Save Big with Travelocity's Latest Offers!

Tesla Model 3 Lease Deals in 2025 — Best Offers & Comparison

Mortgage Refinance Rates: Unlock the Best Savings Today