2025 Ultimate Guide to Car Loan Calculators: Calculate Your Perfect Auto Financing Today!

Introduction to Car Loan Calculators

In the ever-evolving world of auto financing, understanding your financial commitments is crucial. As we approach 2025, car loan calculators have become indispensable tools for anyone looking to purchase a vehicle. These calculators not only help you estimate monthly payments but also provide insights into interest rates, loan terms, and even the total cost of the loan. In this ultimate guide, we will explore how car loan calculators work, their benefits, and tips to effectively use them to secure the best financing for your new vehicle.

What is a Car Loan Calculator?

A car loan calculator is a digital tool that assists potential car buyers in estimating their monthly payments based on various factors. By inputting details such as the loan amount, interest rate, loan term, and down payment, users can quickly determine what their monthly payments will look like. Additionally, many calculators provide options for comparing different loan scenarios, enabling users to make informed decisions.

How Does a Car Loan Calculator Work?

At its core, a car loan calculator uses a standard formula to compute monthly payments. The formula considers the principal amount of the loan, the interest rate, and the term of the loan. The basic formula is:

M = P[r(1 + r)^n] / [(1 + r)^n – 1]

Where:

- M = Total monthly payment

- P = Loan principal (amount borrowed)

- r = Monthly interest rate (annual interest rate divided by 12)

- n = Number of payments (loan term in months)

This formula helps users understand their financial obligations and allows them to adjust different variables to see how changes affect their monthly payment.

Benefits of Using a Car Loan Calculator

Using a car loan calculator comes with numerous advantages:

- Budgeting Assistance: Calculators enable you to determine how much you can afford to borrow without overstretching your budget.

- Comparison Shopping: You can easily compare different loan offers by adjusting the interest rate, loan term, and down payment.

- Understanding Total Costs: Many calculators provide a breakdown of the total cost of the loan, including interest paid over time.

- Empowerment in Negotiations: Knowing your numbers gives you confidence when negotiating with lenders or dealerships.

Types of Car Loan Calculators

There are several types of car loan calculators available, each serving different purposes:

- Basic Car Loan Calculator: This calculator calculates monthly payments based on the loan amount, interest rate, and loan term.

- Amortization Calculator: This tool generates an amortization schedule showing how much of each payment goes toward the principal and how much goes toward interest.

- Loan Comparison Calculator: This allows users to compare multiple loan scenarios side by side.

- Affordability Calculator: This helps determine how much car you can afford based on your income and expenses.

Factors to Consider When Using a Car Loan Calculator

To make the most of a car loan calculator, it’s essential to consider several factors:

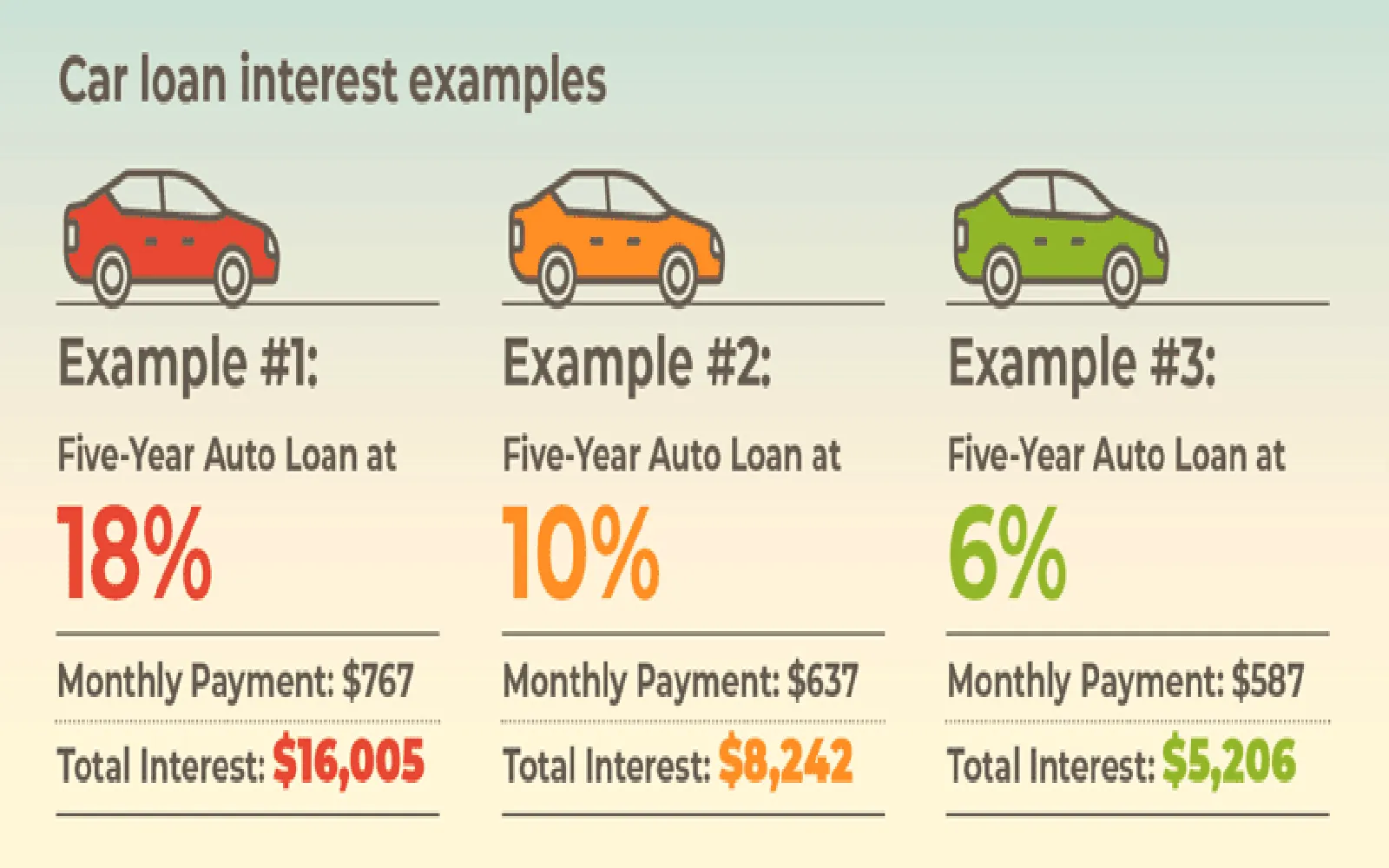

- Interest Rates: Research current market rates and how they apply to your credit profile. A lower interest rate can significantly reduce your monthly payments.

- Loan Term: Shorter loan terms generally mean higher monthly payments but less interest paid over the life of the loan.

- Down Payment: A larger down payment reduces the principal amount, leading to lower monthly payments and less interest.

- Additional Fees: Be aware of additional costs like taxes, registration, and dealer fees that may not be included in the calculator.

Utilizing a Car Loan Calculator Effectively

To effectively use a car loan calculator, follow these steps:

- Gather Your Information: Before you start, have your desired loan amount, interest rate, loan term, and down payment ready.

- Input Your Data: Enter your information into the calculator accurately, ensuring you consider current interest rates and loan terms.

- Analyze Results: Review the monthly payments and total loan costs generated by the calculator. Pay attention to how changes in interest rates or loan terms affect your payment.

- Compare Options: Use multiple calculators to compare different lenders and loan offers, ensuring you find the best deal.

- Refine Your Search: If the payments exceed your budget, adjust your down payment or consider a less expensive vehicle.

Common Mistakes to Avoid

When using a car loan calculator, it's easy to make mistakes that could lead to financial strain. Here are some common pitfalls to avoid:

- Ignoring Additional Costs: Focusing solely on monthly payments can lead to overlooking other costs like insurance, maintenance, and taxes.

- Not Considering Loan Terms: A longer loan term may lower your monthly payment but can result in paying significantly more interest over time.

- Assuming All Lenders Offer the Same Rates: Different lenders may have varying interest rates based on your creditworthiness, so shop around.

- Neglecting to Factor in Your Credit Score: Your credit score has a direct impact on the interest rates you’re offered, so make sure to check yours before applying.

How to Improve Your Chances of Getting a Good Rate

Securing a favorable interest rate can save you substantial money over the life of your auto loan. Here are some tips to improve your chances:

- Check Your Credit Report: Before applying for a loan, review your credit report for errors and take steps to correct them.

- Pay Down Existing Debt: Reducing your debt-to-income ratio can make you more attractive to lenders.

- Make a Larger Down Payment: A larger down payment reduces the loan amount and demonstrates financial responsibility.

- Shop Around: Don’t settle for the first loan offer you receive. Compare rates from multiple lenders.

- Consider Loan Pre-Approval: Getting pre-approved for a loan can give you an advantage in negotiations.

Understanding Loan Terminology

Familiarizing yourself with common auto loan terminology can help you make more informed decisions:

- Principal: The original amount of money borrowed.

- Interest Rate: The percentage charged on the principal, affecting the total cost of the loan.

- Loan Term: The length of time over which the loan must be repaid, usually expressed in months.

- Amortization: The process of paying off a loan through scheduled payments that cover both principal and interest.

- Credit Score: A numerical representation of your creditworthiness, which influences loan eligibility and interest rates.

Conclusion

As we move into 2025, utilizing a car loan calculator can empower you in your vehicle purchasing journey. With the ability to estimate payments, understand total costs, and compare different loan options, these calculators are vital tools for informed decision-making. By being aware of the factors influencing your loan and avoiding common mistakes, you can secure the best financing for your new vehicle. Remember, knowledge is power; take the time to calculate your auto financing today and drive away with confidence!

Explore

Car Financing Offers for 2025: Unlock the Best Deals and Savings Today!

Unlocking the Road to Ownership: Your Ultimate Guide to Auto Financing

Unlock Your Dream Car: The Ultimate Guide to Low Interest Auto Loans in 2025

🚗 Auto Loan Pre-Approval in 2025: Why It Matters & How to Get It

Best Car Lease Deals Today — Save Big on Your Next Ride

Lease Sports Car Deals for 2025: Unleash Your Dream Ride Today!

2025 Car Trade-In Value Estimator: Maximize Your Vehicle's Worth Today!

Unlocking Opportunities: Your Ultimate Guide to Renting the Perfect Office Space