Refinance Private Student Loans of 2024 – Save on Interest and Simplify Your Payments

Refinancing your private student loans in 2024 can help lower your interest rate, reduce your monthly payments, and make it easier to manage your debt. Whether you’re looking to lower your rate or streamline multiple loans into one, refinancing offers a way to take control of your financial future.

🔍 Why Refinance Your Private Student Loans?

| Benefit | Description |

|---|---|

| Lower Interest Rates | Secure a lower rate and save money over the life of your loan |

| Consolidate Loans | Combine multiple loans into one simple monthly payment |

| Lower Monthly Payments | Reduce your monthly payment to better fit your budget |

| Flexible Loan Terms | Choose loan terms that match your financial goals |

| No Prepayment Penalties | Pay off your loan early without any extra charges |

🛠 How to Refinance Your Private Student Loans

| Step | What to Do |

|---|---|

| 1. Check Your Credit Score | A higher credit score often leads to better rates |

| 2. Compare Lenders | Shop around to find the best refinance rates and terms |

| 3. Choose Loan Terms | Decide whether you want a shorter or longer repayment term |

| 4. Apply for Refinancing | Submit your application and provide necessary documents |

| 5. Review and Sign | Read the loan agreement carefully before finalizing the process |

🏆 Top Private Student Loan Refinancing Lenders of 2024

- SoFi – Offers competitive rates, no fees, and flexible repayment terms

- CommonBond – Known for excellent customer service and a variety of repayment options

- Earnest – Customize your payment and term options for more control

- LendKey – Partnering with community banks to offer great rates and terms

- Laurel Road – Offers great refinancing options for medical professionals

Each of these lenders offers unique benefits, so be sure to compare them based on your financial needs and goals.

📝 Important Things to Consider Before Refinancing

| Factor | What to Consider |

|---|---|

| Interest Rates | Compare both fixed and variable rates to find the best option for you |

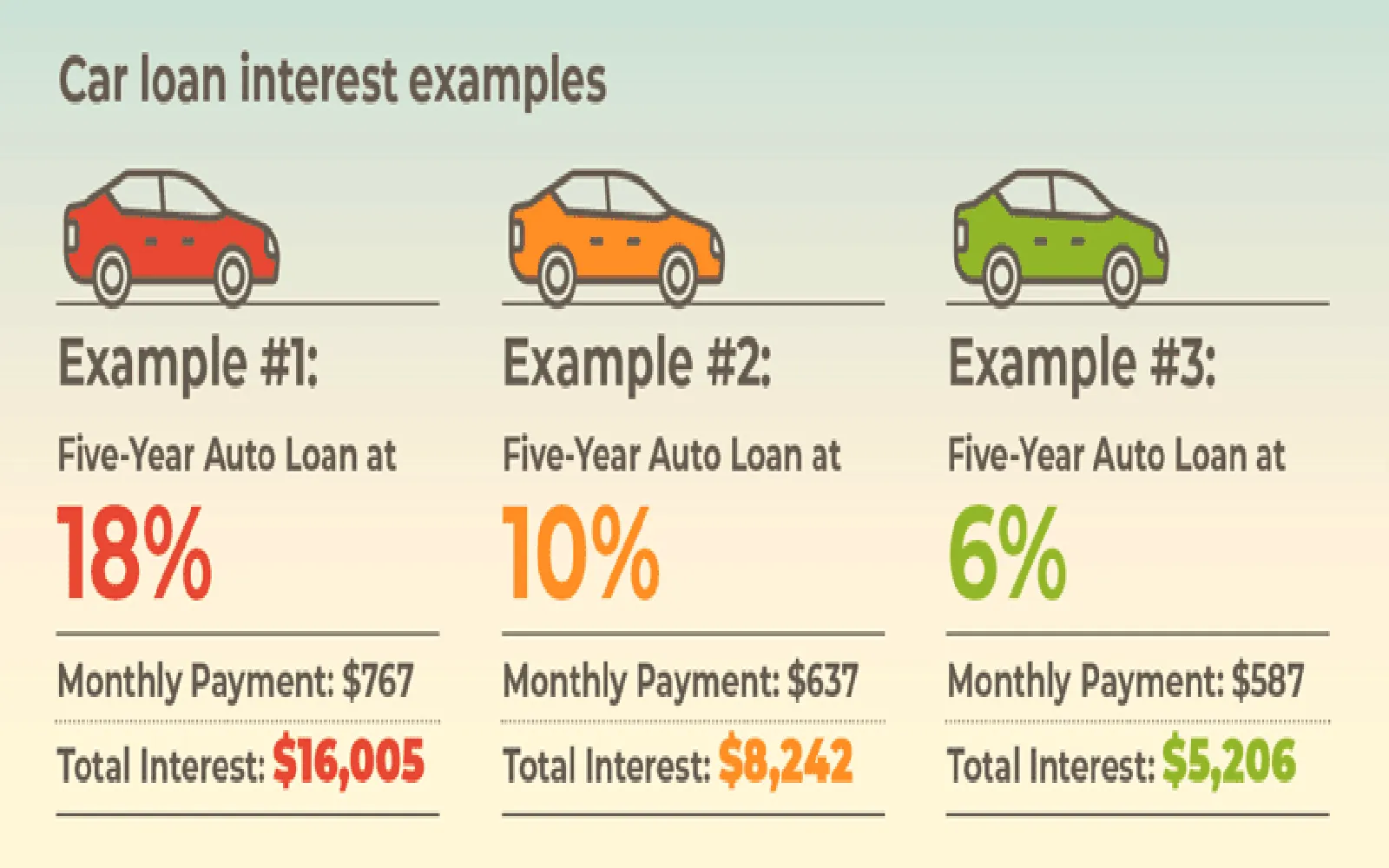

| Loan Terms | Consider the length of the loan and how it affects your monthly payment and total interest |

| Eligibility | Check the lender’s eligibility requirements, including income and credit score |

| Fees | Ensure the lender doesn’t charge any hidden fees for refinancing |

| Cosigner Release | If you have a cosigner, look for lenders that offer cosigner release after a certain period |

✅ Conclusion

Refinancing your private student loans in 2024 can be a smart financial move, helping you save money and simplify your repayment process. With competitive interest rates and flexible terms available, now is a great time to explore refinancing options and find a solution that fits your budget.

Start comparing offers today to see how much you could save.

Explore

Unlocking Your Future: A Comprehensive Guide to Navigating Private Student Loans

Debt Consolidation Loans: Simplify Your Finances & Save

Unlock Your Dream Car: The Ultimate Guide to Low Interest Auto Loans in 2025

Navigating the Maze: Essential Insights into Graduate Student Loans for a Brighter Future

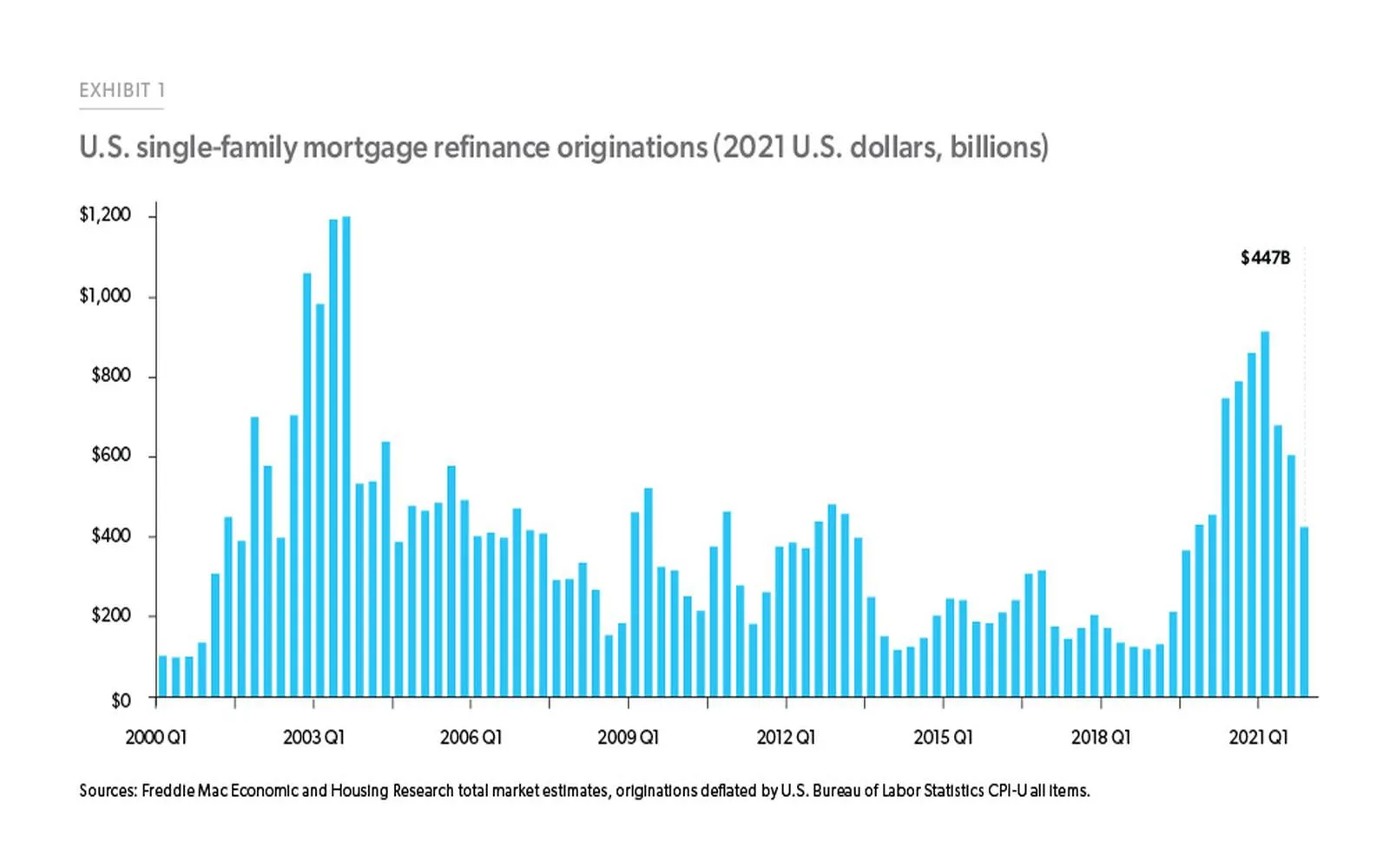

Mortgage Refinance Rates: Unlock the Best Savings Today

Best Payroll Companies to Simplify Your Business Operations

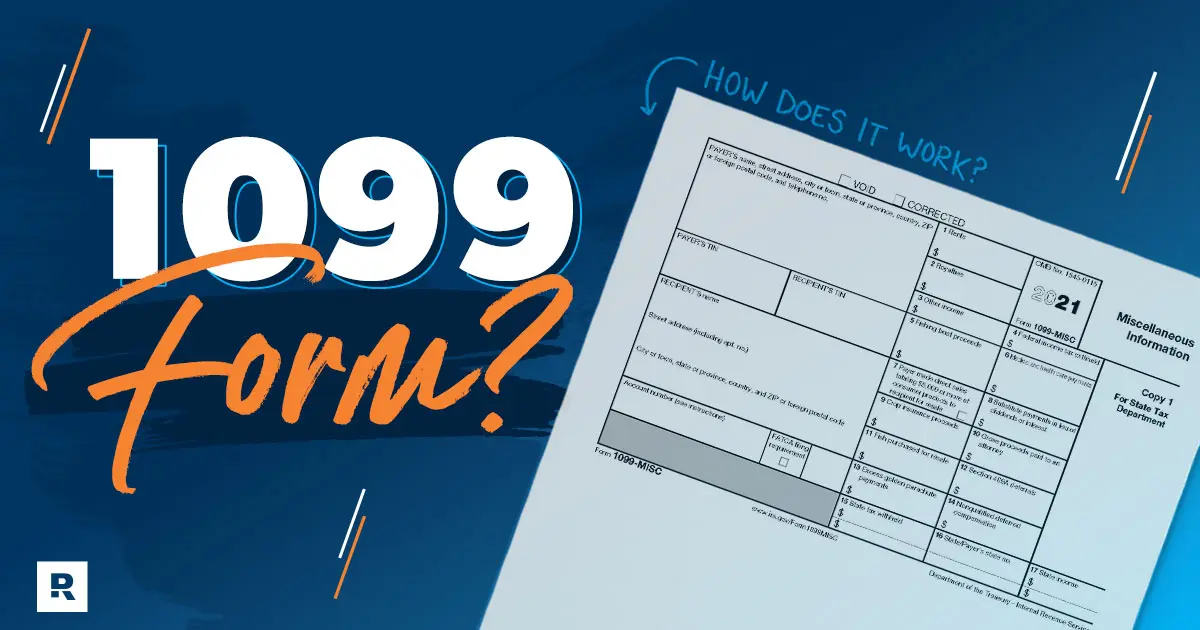

Simplify Your 1099 Payroll Solutions – Efficient & Compliant

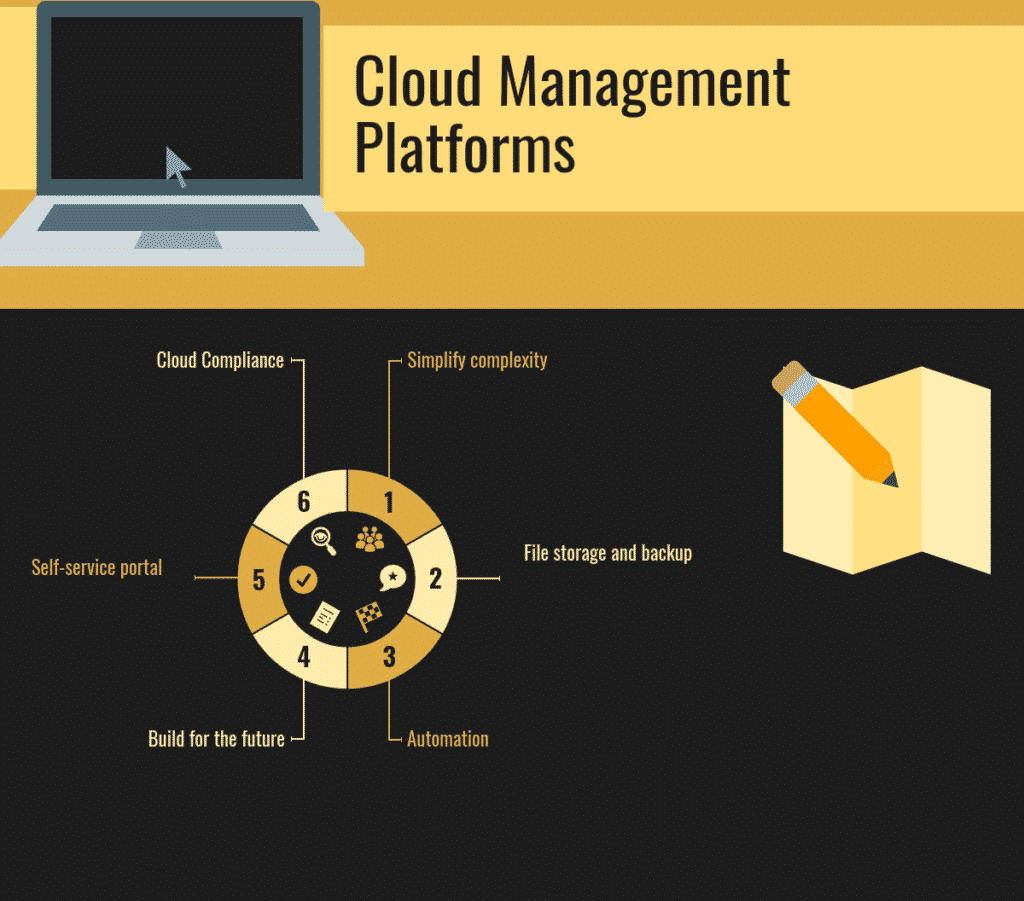

Best Cloud Management Platforms – Simplify Your Cloud Operations