Payroll Software for Small Biz – Simplify Your Payroll Process

Managing payroll for a small business doesn’t have to be stressful. With the right payroll software for small biz, you can streamline your payroll processes, ensure tax compliance, and keep your employees satisfied—all without spending countless hours on calculations and paperwork. The best payroll software can help you save time and reduce errors, allowing you to focus on growing your business.

Why Small Businesses Need Payroll Software

Running payroll manually or using outdated systems can lead to costly mistakes, such as incorrect tax calculations, missed payments, or late filings. This is where payroll software for small biz comes in. Here are some of the key benefits:

- Accuracy Payroll software automatically calculates wages, deductions, taxes, and overtime, reducing the risk of human error and ensuring your employees are paid correctly.

- Time-Saving With payroll software, you no longer have to spend hours manually entering data or figuring out complicated tax laws. The software does it all for you in minutes.

- Tax Compliance Staying compliant with tax laws is essential for small businesses. Payroll software helps you calculate and file your taxes correctly, reducing the risk of penalties.

- Employee Self-Service Many payroll solutions allow employees to view their pay stubs, update personal information, and manage their benefits, saving you time and effort.

🌟 Best Payroll Software for Small Biz in 2024

If you're ready to simplify your payroll process, here are some of the best payroll software for small biz that can help you streamline your payroll:

- Gusto Key Features: Gusto is an easy-to-use payroll solution for small businesses that offers automatic payroll processing, tax filings, and benefits management. It also offers employee self-service options and integrates with accounting software like QuickBooks. Best For: Small businesses looking for an affordable, comprehensive payroll solution that handles taxes, benefits, and compliance.

- QuickBooks Payroll Key Features: QuickBooks Payroll integrates seamlessly with QuickBooks accounting software, making it easy for small businesses to handle payroll and financial management in one place. It offers direct deposit, tax filing, and online access. Best For: Small businesses already using QuickBooks for accounting and looking for a payroll solution that integrates with their financial system.

- OnPay Key Features: OnPay provides simple, affordable payroll software with features like automatic tax filing, direct deposit, and employee management. It also offers benefits administration for small businesses. Best For: Small businesses looking for an easy-to-use, cost-effective payroll solution with all the basic features needed for payroll processing.

- Paychex Flex Key Features: Paychex Flex offers a scalable payroll solution that can grow with your business. It includes features like payroll processing, tax filing, employee benefits management, and HR tools. Best For: Small businesses looking for a payroll solution that offers scalability and advanced HR features as they grow.

- Wave Payroll Key Features: Wave Payroll is a simple payroll software designed for small businesses. It offers easy-to-use payroll features like automatic tax calculations, direct deposit, and tax filing. Wave also integrates with Wave Accounting. Best For: Small businesses looking for an affordable payroll solution that integrates with other business tools like Wave Accounting.

- Zenefits Key Features: Zenefits offers payroll software along with a suite of HR tools, including benefits management, time tracking, and compliance tracking. It’s designed for small businesses that need a complete HR and payroll solution. Best For: Small businesses that want a combined HR and payroll solution with benefits and time-tracking capabilities.

🔧 Key Features to Look for in Payroll Software for Small Biz

When selecting payroll software for small biz, it’s important to consider several features to ensure it meets your needs. Here are some essential features to look for:

| Feature | Description |

|---|---|

| Automatic Tax Calculations | The software should automatically calculate federal, state, and local taxes to ensure compliance and avoid errors. |

| Direct Deposit | Make payroll faster and more secure by using direct deposit for employee payments. |

| Employee Self-Service | Let employees access their pay stubs, update personal details, and manage benefits online, saving you time. |

| Tax Filing and Reporting | Choose software that handles tax filings automatically, ensuring that your taxes are paid on time and correctly. |

| Easy Integration | Look for payroll software that integrates with your existing accounting or HR software to streamline processes. |

| Scalability | As your business grows, you’ll need payroll software that can scale with your needs, such as adding employees or offering additional benefits. |

| Affordable Pricing | Payroll software for small businesses should be budget-friendly, offering all the essential features without unnecessary extras. |

🔍 How to Choose the Best Payroll Software for Small Biz

Choosing the right payroll software for small biz depends on several factors, including the size of your business, your payroll complexity, and your budget. Here are a few questions to consider when making your decision:

- How many employees do you have? For businesses with fewer employees, a simpler, more affordable payroll solution like OnPay or Wave Payroll might be a good fit. Larger businesses may need the advanced features offered by Gusto or Paychex Flex.

- Do you need additional HR features? Some payroll software solutions, like Zenefits and Paychex, offer integrated HR features, such as employee benefits management and time tracking. If you need these features, consider a more comprehensive platform.

- What is your budget? Payroll software pricing varies, so it’s important to select a solution that fits within your budget while still offering the features you need. Solutions like Wave Payroll offer a free version with basic payroll features, making it a good option for businesses on a tight budget.

- What’s your preferred method of payment? Some payroll software providers, such as QuickBooks Payroll, offer more advanced payment options, while others, like Gusto, focus on direct deposit. Make sure the software supports your preferred payment method.

- Do you need tax filing capabilities? If handling taxes is a concern, choose software that automates tax filing to reduce the risk of errors and penalties.

✅ Conclusion: Find the Best Payroll Software for Your Small Business

The best payroll software for small biz helps save time, reduces errors, and ensures compliance with tax laws. Whether you're a startup or a growing small business, there is payroll software available that fits your needs and budget.

Take the stress out of payroll and choose a solution that suits your business. Start simplifying your payroll today with the right payroll software that ensures timely payments, tax compliance, and employee satisfaction.

Explore

Top Payroll Software Solutions: Streamline Your Business's Payroll Process in 2023

Best Payroll Service – Simplify Your Payroll Management

Best Payroll Companies to Simplify Your Business Operations

Simplify Your 1099 Payroll Solutions – Efficient & Compliant

Payroll Software: Streamlining Payroll Management for Businesses

Debt Consolidation Loans: Simplify Your Finances & Save

Refinance Private Student Loans of 2024 – Save on Interest and Simplify Your Payments

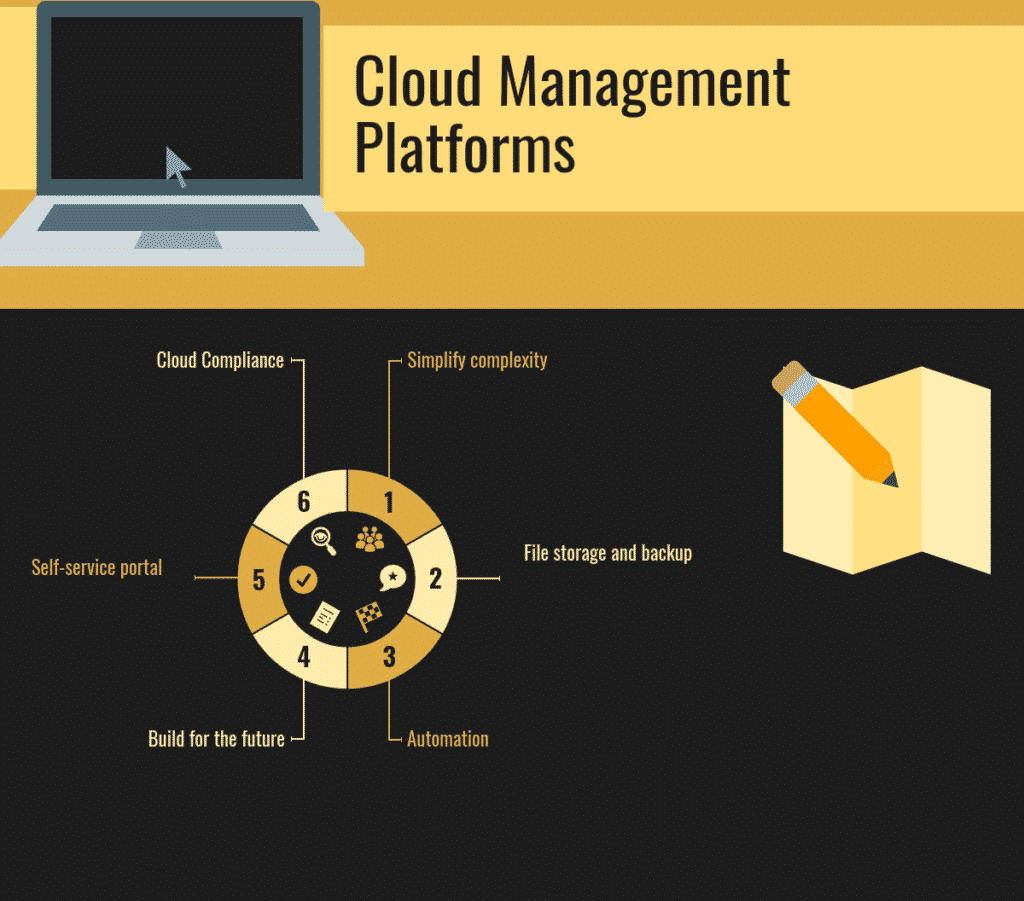

Best Cloud Management Platforms – Simplify Your Cloud Operations