Best Payroll Service – Simplify Your Payroll Management

Running a business involves a lot of moving parts, and managing payroll can be one of the most time-consuming and complicated tasks. A reliable payroll service can help you process employee wages, taxes, and benefits accurately and efficiently. Whether you're a small business or a large enterprise, finding the right payroll service can save you time, reduce errors, and ensure compliance with tax laws.

Why You Need a Payroll Service

Handling payroll manually is not only tedious but also comes with significant risks, such as missed deadlines, compliance issues, and inaccurate tax filings. A payroll service eliminates these challenges and offers several benefits:

- Time-Saving Outsourcing your payroll allows you to focus on running your business rather than spending hours on calculations and paperwork.

- Accurate Calculations Payroll services use advanced software to ensure accurate calculations of employee wages, deductions, taxes, and overtime.

- Tax Compliance A professional payroll service ensures that all federal, state, and local taxes are calculated and submitted on time, reducing the risk of fines or penalties.

- Employee Satisfaction Timely and accurate payments help maintain trust with your employees, which leads to higher morale and lower turnover rates.

🌟 Top Payroll Services in 2024

Here are some of the best payroll services that can help you simplify your payroll processes and ensure compliance:

- Gusto Key Features: Gusto is an all-in-one payroll service that offers easy-to-use payroll processing, tax filing, benefits management, and HR tools. It supports small businesses with automatic tax calculations and filings, direct deposit, and employee self-service. Best For: Small to medium-sized businesses looking for an easy-to-use, affordable payroll solution with HR support.

- ADP Key Features: ADP is one of the largest payroll providers, offering comprehensive payroll services, tax compliance, HR tools, and benefits administration. ADP also provides customizable solutions for businesses of all sizes. Best For: Large businesses or enterprises that need advanced payroll features, global payroll support, and full-service HR solutions.

- Paychex Key Features: Paychex provides a range of payroll services, from basic payroll processing to more advanced features like time tracking, tax filing, and employee benefits management. Paychex offers both online and mobile payroll solutions for businesses. Best For: Growing businesses that need flexibility and scalability in their payroll management.

- QuickBooks Payroll Key Features: QuickBooks Payroll offers a simple solution for small businesses. It integrates directly with QuickBooks accounting software, providing seamless payroll processing, tax filing, and reports. QuickBooks also offers a self-service option for employees. Best For: Small businesses that already use QuickBooks for accounting and want an easy payroll solution integrated with their financial software.

- OnPay Key Features: OnPay is a cloud-based payroll service that provides payroll processing, tax filing, benefits management, and compliance support. It is known for its affordable pricing and ease of use, especially for small businesses and startups. Best For: Small businesses and startups looking for a cost-effective, easy-to-use payroll service with full features.

- Zenefits Key Features: Zenefits offers a comprehensive HR platform that includes payroll processing, employee benefits, time tracking, and compliance management. It’s designed to simplify HR and payroll in a single solution. Best For: Growing businesses that want a combined HR and payroll solution with features like employee benefits and time tracking.

🔧 Features to Look for in the Best Payroll Service

When choosing a payroll service, it’s important to consider several features to ensure it meets the needs of your business:

| Feature | Description |

|---|---|

| Automated Payroll Processing | The best payroll services automate payroll calculations, tax filings, and direct deposits, reducing the risk of errors and saving time. |

| Tax Compliance | Payroll services must ensure that all local, state, and federal taxes are calculated and filed on time to avoid penalties. |

| Employee Self-Service | Features like self-service portals allow employees to access their pay stubs, update personal information, and manage benefits. |

| Direct Deposit | Direct deposit is a key feature for ensuring employees are paid quickly and securely without the need for paper checks. |

| Benefits Administration | Look for a payroll service that can help manage employee benefits such as health insurance, 401(k) plans, and other perks. |

| Mobile Access | Many payroll services offer mobile apps that allow you to process payroll, approve payments, and access reports from anywhere. |

| Scalability | Choose a service that can grow with your business, offering the ability to add more employees or features as needed. |

🔍 How to Choose the Best Payroll Service for Your Business

Selecting the right payroll service depends on several factors, including the size of your business, the complexity of your payroll needs, and your budget. Here are some questions to ask when evaluating payroll services:

- How many employees do you have? For small businesses with fewer employees, a more affordable solution like Gusto or OnPay may be sufficient. Larger businesses may need the advanced features provided by ADP or Paychex.

- Do you need HR features beyond payroll? If you need benefits management, employee tracking, or compliance tools, a more comprehensive solution like Zenefits or ADP may be the best choice.

- What is your budget? Payroll services vary in cost, so it’s important to select a service that fits within your budget while still offering the features your business needs.

- How complex is your payroll? If your payroll is simple (e.g., hourly or salaried employees), a basic solution like QuickBooks Payroll may be enough. For businesses with complex payroll requirements (e.g., contractors, multiple locations), you may need a more robust service like Paychex.

- What kind of customer support do you need? Ensure that the payroll service you choose offers good customer support, including phone, email, and chat options, so you can resolve any issues quickly.

✅ Conclusion: Simplify Payroll with the Best Payroll Service

The best payroll service can help you manage your payroll efficiently, reduce the risk of errors, and ensure compliance with tax laws. Whether you’re a small business or a large enterprise, there are payroll solutions to suit your needs. Take the time to explore different options, and choose the service that offers the best features, support, and pricing for your business.

Start streamlining your payroll today with the right payroll service that ensures timely and accurate payments, tax compliance, and employee satisfaction.

Explore

Payroll Software for Small Biz – Simplify Your Payroll Process

Best Payroll Companies to Simplify Your Business Operations

Simplify Your 1099 Payroll Solutions – Efficient & Compliant

Payroll Software: Streamlining Payroll Management for Businesses

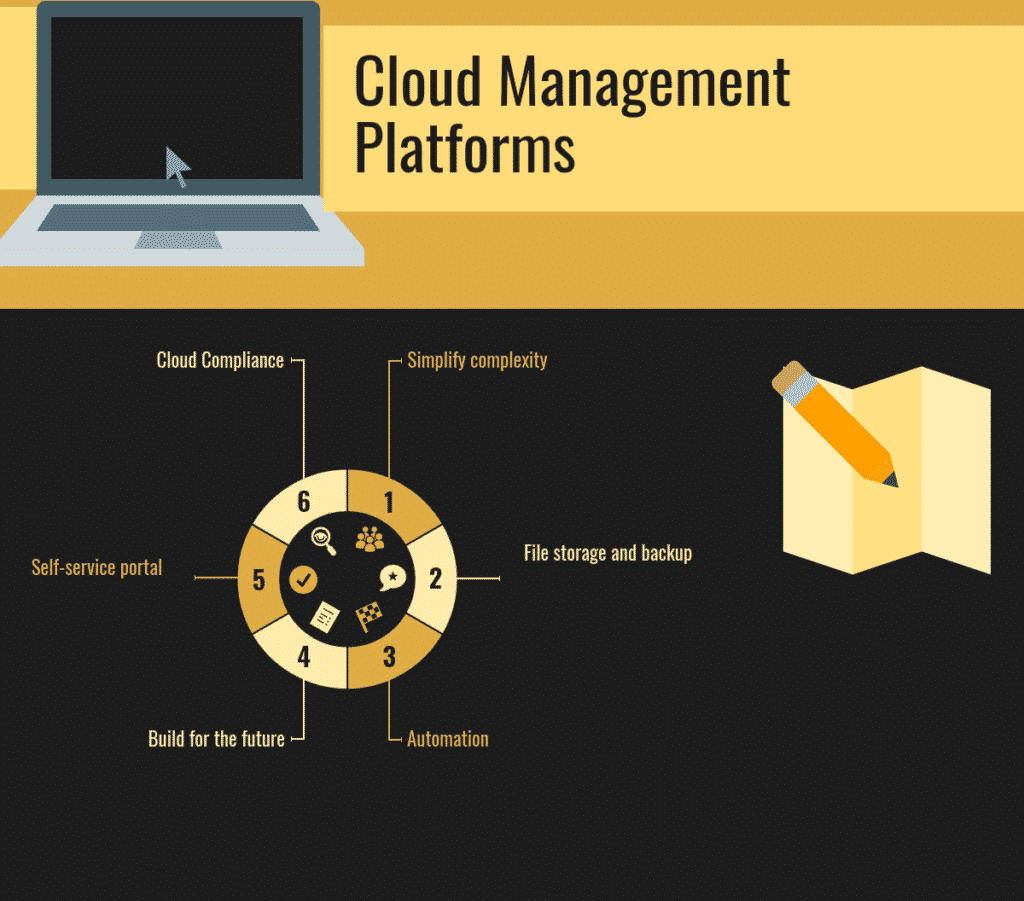

Best Cloud Management Platforms – Simplify Your Cloud Operations

Top Payroll Software Solutions: Streamline Your Business's Payroll Process in 2023

Debt Consolidation Loans: Simplify Your Finances & Save

Refinance Private Student Loans of 2024 – Save on Interest and Simplify Your Payments