Find the Best Mortgage Lenders in the USA (2025)

Buying a home or refinancing your mortgage? Choosing the right mortgage lender is one of the most important financial decisions you’ll make. The right lender can save you thousands in interest — and the wrong one can cost you even more.

🏦 Who Are the Best Mortgage Lenders?

The best lender depends on your unique financial situation — but here are the top categories most borrowers choose from:

- National Banks – Known for strong reputations and traditional in-person service (e.g., Chase, Wells Fargo, Bank of America)

- Online Lenders – Faster applications, low overhead, and competitive rates (e.g., Rocket Mortgage, Better.com, SoFi)

- Credit Unions – Often offer lower fees and better rates for members

- Mortgage Brokers – Shop rates across multiple lenders on your behalf

- Government-Backed Lenders – FHA, VA, and USDA lenders help those with low credit or no down payment

📊 Key Factors to Compare

When choosing a mortgage lender, consider the following:

- Interest Rate – Fixed or adjustable, this affects your monthly payment

- APR – Includes interest plus fees, giving a fuller picture of cost

- Loan Types Available – Conventional, FHA, VA, Jumbo, etc.

- Down Payment Requirements – Some programs accept as low as 3%

- Credit Score Requirements – Minimum scores vary by lender

- Closing Costs & Fees – Some lenders offer no-closing-cost options

- Customer Support & Reviews – Especially for first-time homebuyers

🏠 Common Mortgage Loan Types

Here’s a quick look at popular loan types offered by top lenders:

- Conventional Loans – Good for borrowers with strong credit and down payments

- FHA Loans – Backed by the government, ideal for lower credit scores

- VA Loans – Available to military service members and veterans

- USDA Loans – For rural properties and qualified buyers

- Jumbo Loans – For properties above standard loan limits

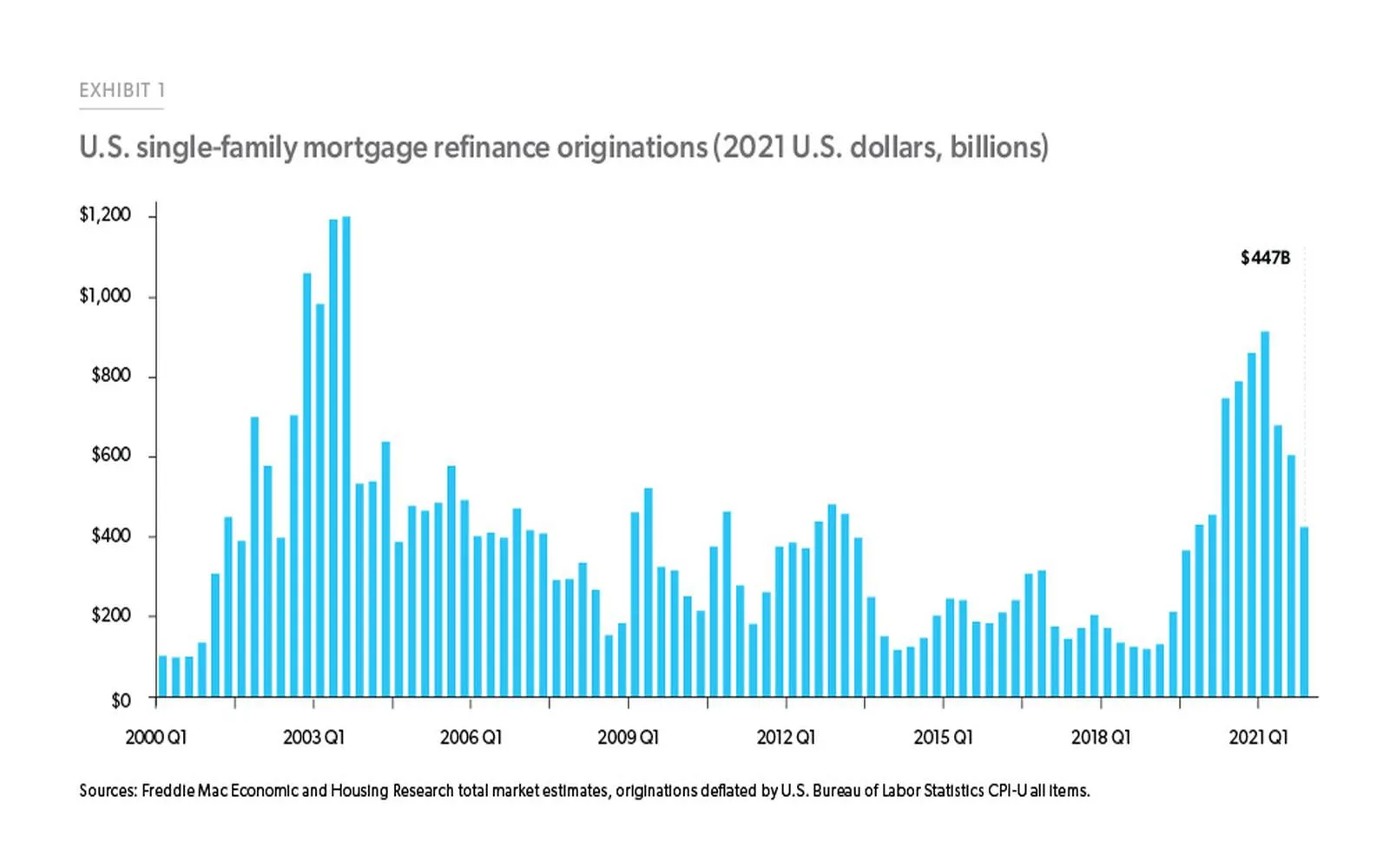

- Refinance Loans – Lower your rate or tap into home equity

✅ Conclusion

A mortgage is more than a loan — it’s a long-term commitment that can shape your financial future. Whether you’re buying your first home, refinancing, or upgrading to your forever home, the right mortgage lender can make all the difference.

Explore

Unlocking Homeownership: Your Guide to Choosing the Right Mortgage Lender

Mortgage Refinance Rates: Unlock the Best Savings Today

What Is a Mortgage Lender and How to Choose the Right One

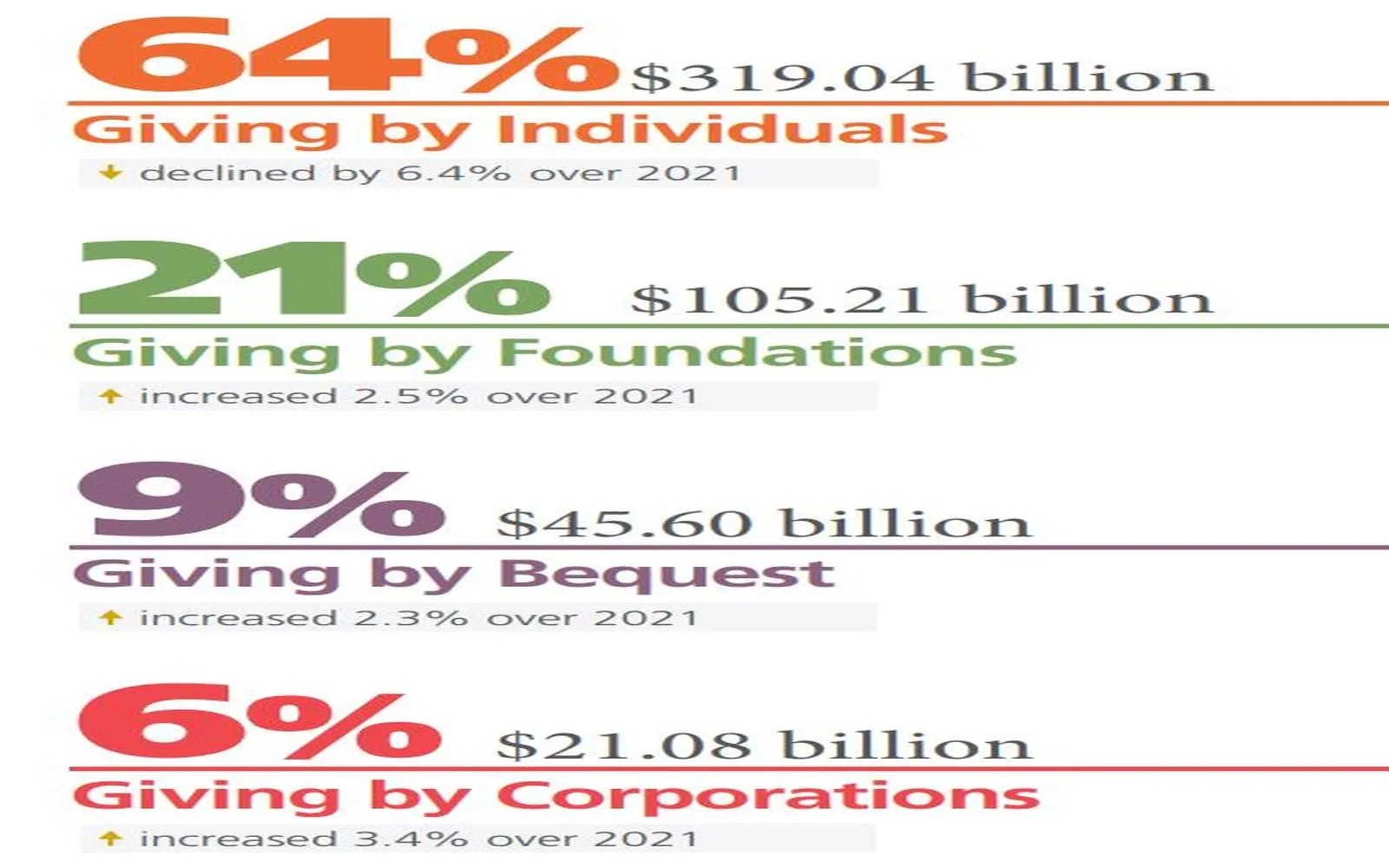

Ultimate Guide: How to Donate Effectively in the USA - Tips and Resources

Guide to Donating in the USA: Make Your Contribution Count

How They Help Your Business Find the Best Employee Benefits

Guide to Find Perfect Realtor as a First-Time Home Buyer

Find the Best Local Law Firms for Expert Legal Representation