Small Business Health Insurance – Affordable Coverage for You and Your Employees

As a small business owner, providing health insurance for your employees is a great way to attract and retain top talent while ensuring their well-being. But navigating the world of small business health insurance can be complex. In this guide, we’ll help you understand the benefits of offering health insurance to your employees, explore different plans, and assist you in selecting the best options for your company’s needs.

Why Offer Health Insurance to Your Employees?

Providing health insurance isn’t just a great employee benefit—it can also be a powerful business tool. Here’s why offering small business health insurance is crucial:

- Attract and Retain Talent Health benefits are one of the top perks employees look for when choosing a job. Offering a competitive health insurance package can help you stand out in the job market and retain high-quality staff.

- Improve Employee Productivity Healthy employees are more productive. By providing access to health care, you ensure that your employees can receive the care they need to stay healthy and perform at their best.

- Tax Benefits Small business owners can receive tax incentives for providing health insurance. The Small Business Health Care Tax Credit can help reduce the cost of offering health coverage to your employees.

- Employee Satisfaction and Loyalty When you offer health insurance, your employees feel valued. Providing health care coverage can increase morale and improve employee loyalty.

Types of Small Business Health Insurance Plans

There are several types of health insurance plans available for small businesses, each designed to suit different needs. Let’s break down the most common options:

1. Health Maintenance Organization (HMO) Plans

- HMO plans are cost-effective and often offer lower premiums.

- Employees choose a primary care physician (PCP) and need a referral to see specialists.

- Coverage is usually limited to a specific network of doctors and hospitals.

2. Preferred Provider Organization (PPO) Plans

- PPO plans offer more flexibility in choosing healthcare providers, both in-network and out-of-network.

- Employees don’t need referrals to see specialists, and they can visit any doctor or specialist without a referral, though out-of-network care will usually come with higher costs.

- These plans typically come with higher premiums but are preferred by employees who value more healthcare choices.

3. High Deductible Health Plans (HDHP) with Health Savings Accounts (HSA)

- HDHPs have higher deductibles but lower premiums, making them an affordable option for small businesses.

- Employees can contribute to an HSA to help pay for medical expenses, which offers tax advantages.

- These plans are a good choice for healthy employees who don’t need frequent medical care.

4. Exclusive Provider Organization (EPO) Plans

- EPO plans offer a smaller network of providers but usually provide lower premiums than PPO plans.

- Like HMO plans, EPO plans typically do not cover out-of-network care, except in emergencies.

5. Point of Service (POS) Plans

- POS plans combine elements of HMO and PPO plans.

- Employees select a primary care physician, but they have the option to see out-of-network providers at a higher cost.

- POS plans tend to be more flexible than HMOs but less so than PPOs.

How to Choose the Best Health Insurance Plan for Your Small Business

Choosing the right health insurance plan for your small business can be challenging, but keeping these factors in mind can help:

1. Employee Needs and Preferences

- Assess your employees’ needs. Do they prefer flexibility in choosing doctors and specialists? Or would they be okay with a more limited network if it means lower premiums?

- Consider offering multiple plan options to cater to the varying preferences of your employees.

2. Premium and Deductible Costs

- Balance the cost of premiums with the deductible levels. A plan with low premiums might have high deductibles, and vice versa. Make sure it aligns with your budget and your employees' financial preferences.

- Check if you qualify for the Small Business Health Care Tax Credit to help reduce premium costs.

3. Network Coverage

- If your employees live in different areas, check if the health insurance plan offers a nationwide or regional network.

- Ensure that local hospitals, doctors, and clinics are included in the plan's network to minimize out-of-pocket costs for your employees.

4. Employer Contributions

- Decide how much of the premium cost your business is willing to cover. While it’s common for employers to cover at least part of the cost, some businesses contribute a fixed percentage of the premium, while others might contribute a flat dollar amount.

- Offering generous contributions can increase employee satisfaction and attract top talent.

5. Plan Flexibility

- Consider offering additional health benefits such as dental, vision, or life insurance to round out your employees' health coverage. You can often bundle these with your main health insurance plan for a better deal.

How to Apply for Small Business Health Insurance

- Research Insurance Providers Start by researching different insurance providers who offer small business health plans. Compare costs, coverage options, and ratings from other business owners.

- Get Quotes from Multiple Providers Request quotes from several insurance providers. You may be able to get a group plan that offers significant savings compared to individual plans.

- Determine Eligibility for Tax Credits Check if your business is eligible for the Small Business Health Care Tax Credit. This can help reduce the overall cost of offering health insurance to your employees.

- Set a Budget Determine how much your business can afford to contribute to health insurance premiums. This will help you narrow down your options and select a plan that fits within your budget.

- Work with an Insurance Broker If you’re not sure which plan to choose, consider working with a health insurance broker who can help you navigate the options and find the best coverage for your employees.

Conclusion: Secure the Health of Your Business and Employees

Providing small business health insurance is a win-win for both you and your employees. Not only does it help you attract and retain top talent, but it also ensures your employees have access to the healthcare they need to stay healthy and productive. By choosing the right plan, you can save money, improve employee satisfaction, and meet the healthcare needs of your workforce.

Start offering health insurance today and invest in the well-being of your business and your team.

Explore

Best Health Insurance Plans for Comprehensive Coverage

Compare AARP Insurance Quotes for Affordable Coverage

Comprehensive Guide to Humana Health Coverage Plans: Benefits, Options, and Enrollment Tips

Car Insurance: What You Need to Know and How to Choose the Right Coverage

Humana Health Benefits: Your Guide to Coverage & Wellness

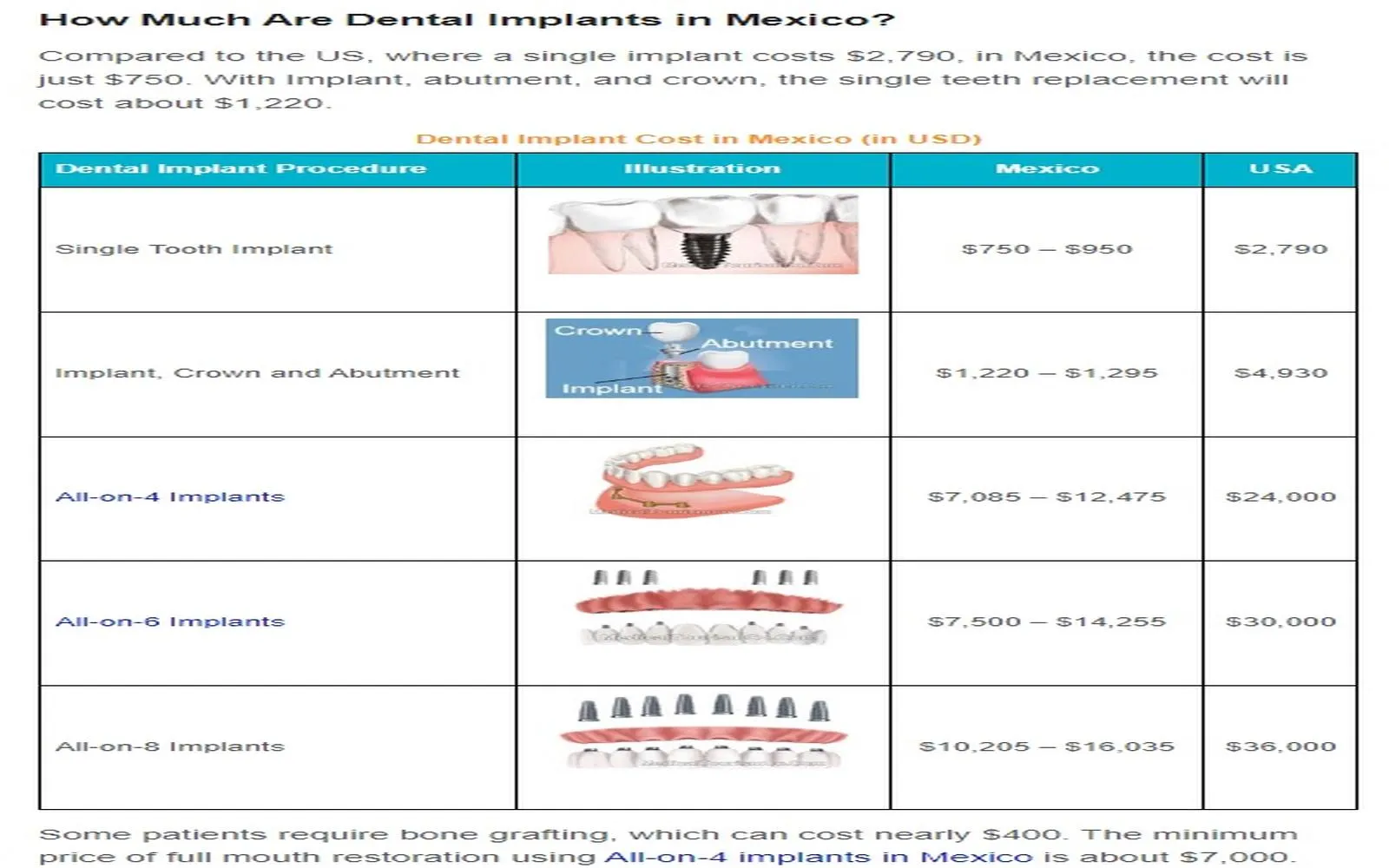

Comprehensive Guide to Dental Insurance with Implant Coverage: What You Need to Know

Homeowners Insurance Near Me – Protect Your Home and Belongings with Trusted Coverage

Get the Best Car Insurance Quotes Online in 2025: Your Ultimate Guide to Savings and Coverage