Electric Car Tax Credit 2025 — How to Save on Your Next EV Purchase

Buying an electric vehicle (EV) in 2025 is not only great for the environment but can also save you thousands of dollars thanks to federal and state electric car tax credits. These incentives make owning an EV more affordable by reducing your tax bill or providing rebates.

💰 What is the Electric Car Tax Credit?

The federal government offers a tax credit of up to $7,500 for eligible new electric vehicles purchased in the U.S. This credit directly reduces the amount of federal income tax you owe. In addition, many states provide their own credits, rebates, or incentives to encourage EV adoption.

🚗 Qualifying Vehicles for 2025 Federal Tax Credit

| Vehicle Model | Max Federal Tax Credit | Key Notes |

|---|---|---|

| Tesla Model 3 (Made in USA) | Up to $7,500 | Must meet battery sourcing and price limits |

| Chevrolet Bolt EV | Up to $7,500 | Available for buyers under income limits |

| Ford Mustang Mach-E | Up to $7,500 | Eligible for full credit based on assembly |

| Nissan Leaf | Up to $7,500 | Qualifies under new rules |

| Hyundai Ioniq 5 | Up to $7,500 | Battery sourcing requirements apply |

*Note: Tax credit eligibility depends on vehicle assembly location, battery components, MSRP caps, and buyer income limits as per the Inflation Reduction Act.

🏛️ State Electric Car Incentives

Many states add their own incentives on top of the federal credit:

| State | Incentive Type | Amount | Additional Benefits |

|---|---|---|---|

| California | Rebate | Up to $2,000 | HOV lane access, utility bill credits |

| New York | Tax Credit + Rebate | Up to $2,000 | Clean Pass Program for EVs |

| Colorado | Tax Credit | Up to $4,000 | Income caps apply |

| New Jersey | Sales Tax Exemption | Full exemption | Plus $5,000 rebate for low-income buyers |

| Oregon | Rebate | Up to $2,500 | Electric utility incentives |

📝 How to Claim Your Electric Car Tax Credit

- Buy a Qualifying New EV Ensure the vehicle meets the latest federal and state eligibility criteria.

- Complete IRS Form 8936 File this form with your federal tax return to claim the credit.

- Check State Program Requirements Some states require separate applications for rebates or tax credits.

- Keep All Purchase Documentation Save your purchase agreement and proof of residency.

- Consult a Tax Professional To maximize benefits and comply with income limits or other rules.

⚠️ Important Updates in 2025

- The Inflation Reduction Act updated rules for battery sourcing, requiring components to come from approved regions to qualify for full credit.

- The vehicle MSRP limit is $55,000 for sedans and $80,000 for SUVs and trucks.

- Buyers with higher incomes may be phased out or ineligible.

- Tax credits now only apply to new vehicles; used EVs may qualify for smaller credits under some programs.

🔎 Popular Electric Cars with Tax Credit Eligibility in 2025

| Model | Price Range | Estimated Federal Credit | Notes |

|---|---|---|---|

| Tesla Model 3 | $40,000 - $55,000 | Up to $7,500 | Must meet assembly & battery rules |

| Chevrolet Bolt EV | $28,000 - $33,000 | Up to $7,500 | Affordable and eligible |

| Ford Mustang Mach-E | $45,000 - $60,000 | Up to $7,500 | Stylish crossover EV |

| Nissan Leaf | $28,000 - $37,000 | Up to $7,500 | Long-time popular EV |

| Hyundai Ioniq 5 | $40,000 - $50,000 | Up to $7,500 | New generation EV |

🌟 Final Tips for Maximizing Your Savings

- Shop Early: Inventory and incentives can change quickly.

- Confirm Vehicle Eligibility: Use the IRS and EPA online tools.

- Consider Lease Options: Some leases pass the credit savings directly to you.

- Look for Combined Savings: Stack federal and state incentives when possible.

Explore

Maximize Your Savings: The 2025 Electric Car Tax Credit Explained

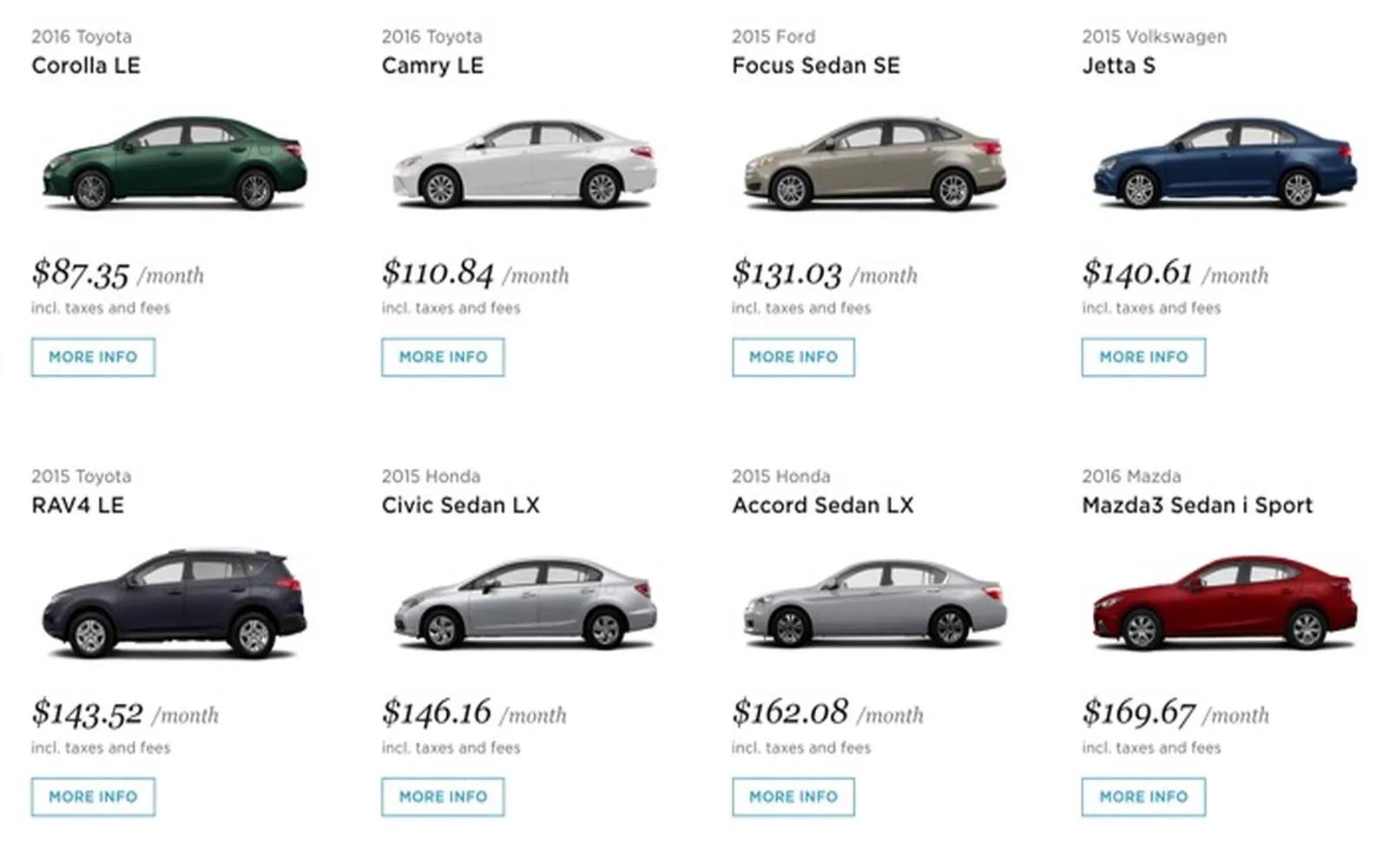

Best Car Lease Deals Today — Save Big on Your Next Ride

Best Oil Change Coupons in 2025 — Save on Your Next Service!

Maximize Your Savings: Electric Car Incentives to Watch for in 2025

Electric Car Leases of 2025: Best Deals for Eco-Friendly Drivers

Car Lease Deals of 2025: Unlock Affordable Options for Your Next Ride

Affordable Electric Cars: Your Ultimate Guide to Budget-Friendly EVs in 2025

Electric Cars in 2025: The Future of Sustainable Driving and Innovative Technology